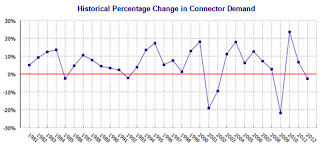

Since 1980 the Connector Industry has experienced four growth business cycles, meaning consecutive years of increases in year-over-year sales. The average growth business cycle in the connector industry is six years. The longest (years without a decline in sales) is eight years (1993-2000).

The downturn of 2011/2012 has somewhat broken the industry mold. The period of growth lasted only 23 months before sales began declining in 4Q11. The downturn, which was over in October 2012, lasted only 12 months. The decline was only -2.6% which is the smallest measured since 1980.

Since 1980, we have achieved twenty-six years of sales increases and five years of sales declines. The average growth cycle lasts six years, with four years being the shortest growth cycle and eight years the longest. The industry’s thirty-one year compound annual growth (CAGR) is +5.7%. Only once in thirty-one years have we had two consecutive years of declining sales.

In the three industry declines prior to 2001, the years of growth in between the downturns was four, six, and eight years. From the end of the 2001/2 downturn to the beginning of the 2008/9 downturn was 75 months (6.3 years). From the end of the 2008/9 downturn to the beginning of the 2011/12 downturn was 23 months (1.9 years). The decreasing cycle rate may be the result of the increasing inter-dependencies of the world’s economies and our 24/7 processing of the news of all types.

|

| Historical percentage Change in Connector Demand |

Historically we are at the beginning of a fifth growth business cycle that will last another five years on average. Although nothing is certain, it is likely that the next downturn is three or more years down the road, given no unforeseen major calamities. The economies of the world and their governments have gone (and are going) through a major fiscal correction, which should lead to relatively stable times where the growth rates will, in all likelihood, be more modest than they have been after past industry downturns.

2012 Outlook

There are some headwinds facing the industry in 2013.

- The economic malaise in Europe is still prevailing. The austerity budgets in Europe to fix the deficit spending have generally slowed several economies and thrown others into a shallow recession. Although the European Union is working together to sort through the issues, it is uncertain how long it will take to re-establish healthy economic growth in the region.

- Although modest GDP growth has been achieved in the United States for the last 11 quarters, it has not been sufficient to bring total unemployment down to pre-recession numbers and consumer confidence has been wavering. If federal budget reductions and tax reform plans drag out through the year, the economic growth will be impacted adversely.

- China’s GDP growth has been slowing for the last 10 quarters from 11.9% YOY to 7.4% YOY in 3Q12. Additional problems in Europe or the United States would reduce their growth further.

- China’s growth in their internal markets has been fueled by rising wages and easily available credit. The Chinese consumers may have taken on to much credit which could lead to reduced consumption if the cost of credit increases or the source of income is lost.

- Continued unrest in the Middle East could destabilize worldwide financial markets and economies.

The Bottom Line

Industry sales growth in the range of +4.2% is a likely result for 2013. Some sales growth is almost certain given the easy comparison to 2012 and the relative stability (for good or bad) of the current economic/political status of the world. For the same reasons, growth significantly above this level is unlikely as the events needed to drive the higher growth would already need to have begun unfolding to significantly impact the year.

The only opportunity for a significant downside is the unforeseen event, either manmade or from nature, that could substantially disrupt the worldwide economy.

Learn more about this Market Report, "Connector Industry Forecast" at MarketInfoResearch.com.

No comments:

Post a Comment